Koç, Utku

Loading...

Profile URL

Name Variants

Koç U

Utku Koç

Koc U

Utku Koç

Koc U

Job Title

Email Address

kocu@mef.edu.tr

Main Affiliation

02.01. Department of Industrial Engineering

Status

Current Staff

Website

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Files

Sustainable Development Goals

2

ZERO HUNGER

0

Research Products

16

PEACE, JUSTICE AND STRONG INSTITUTIONS

0

Research Products

1

NO POVERTY

0

Research Products

11

SUSTAINABLE CITIES AND COMMUNITIES

0

Research Products

7

AFFORDABLE AND CLEAN ENERGY

0

Research Products

10

REDUCED INEQUALITIES

0

Research Products

3

GOOD HEALTH AND WELL-BEING

0

Research Products

6

CLEAN WATER AND SANITATION

0

Research Products

9

INDUSTRY, INNOVATION AND INFRASTRUCTURE

1

Research Products

12

RESPONSIBLE CONSUMPTION AND PRODUCTION

0

Research Products

5

GENDER EQUALITY

0

Research Products

14

LIFE BELOW WATER

0

Research Products

13

CLIMATE ACTION

0

Research Products

15

LIFE ON LAND

0

Research Products

8

DECENT WORK AND ECONOMIC GROWTH

0

Research Products

17

PARTNERSHIPS FOR THE GOALS

0

Research Products

4

QUALITY EDUCATION

0

Research Products

This researcher does not have a Scopus ID.

This researcher does not have a WoS ID.

Scholarly Output

16

Articles

4

Views / Downloads

3739/38169

Supervised MSc Theses

12

Supervised PhD Theses

0

WoS Citation Count

19

Scopus Citation Count

24

WoS h-index

3

Scopus h-index

3

Patents

0

Projects

6

WoS Citations per Publication

1.19

Scopus Citations per Publication

1.50

Open Access Source

14

Supervised Theses

12

| Journal | Count |

|---|---|

| Computers & Industrial Engineering | 1 |

| Eskişehir Osmangazi Üniversitesi Mühendislik ve Mimarlık Fakültesi Dergisi (online) | 1 |

| Operations Research Letters | 1 |

| Turkish Journal of Electrical Engineering & Computer Sciences | 1 |

Current Page: 1 / 1

Scopus Quartile Distribution

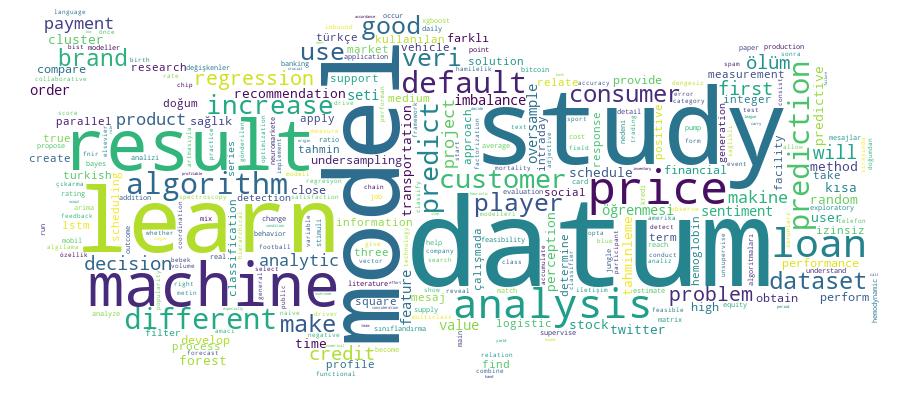

Competency Cloud

16 results

Scholarly Output Search Results

Now showing 1 - 10 of 16

Master Thesis Big Data Analytics on Used Car Information(MEF Üniversitesi Fen Bilimleri Enstitüsü, 2021) Demir, Efe; Utku KoçIn this research, a decision support system is implemented on a used car dataset. The main purpose is to predict the price information and reveal the related features. The price prediction problem is classified as a regression problem. The key point is to find the best-fitting model and obtain the best accurate prediction outcomes. Should we buy this car, or at what price may I sell my car? This work is about to answer these questions. Various regression models are compared, and detailed results are explained correspondingly.The constructed models will help customers to know about their car price and salability. And they can identify the buying opportunities. The percentage error approach which is detailed in the results section will be a guideline for customers/firms to make a market analysis or detect fraudulent listing information.Master Thesis Prediction of Up and Down Signalsın Selected Blues Chip Stocks(MEF Üniversitesi, Fen Bilimleri Enstitüsü, 2019) Yıldız, Mustafa; Koç, UtkuEfforts have been made to predict the direction in which equity stocks will move in the capital markets. In most of these studies, Technical Analysis and Fundamental Analysis based models have been used. For daily price estimations, macroeconomic variables or financial ratios of financial instruments are used. On the other hand trade book data are taken into consideration in intraday price estimates. In this study, equity market data analytics, which are created by Borsa İstanbul as a benchmark for intraday price signals, are used. These analytics are derived from trade and order book data. For 5 minute periods, intraday price and equity market data analytics data sets are created, and different algorithms are tried over these data sets. The study is carried out using one-week data of 4 selected blue chip stocks. The signals for increase is 1, for decreases is -1 and 0 for non-change signals. As a result of the study, the decision jungle algorithm is the most successful algorithm. In addition this, the lack of volatility and liquidity in the market have caused overfitting problems in ensemble algorithms. According to the multiclass decision jungle confusion matrix, the positive true results for 1 (or increase of the price) are promising. If an investors can just use the algorithm for the price increase, it will be meaningful. The true positive ratio of 1, 54.5%, is too high when it is compared with its false trues value for decrease (or -1), which is just 13.6%. The difference between true positive and false negative (54.5% - 13.6%) will be the earning ratio for the investor, if he/she decides to invest the price increase of Yapi Kredi stock with the decision jungle algorithm. Although it is stated that big data algorithms (machine learning techniques) can give the best results for the data, domain knowledge related to the data is still very important. As it is seen in the study, in order to overcome the problems of overfitting or bias that occur in other studies, it is necessary to obtain sufficient domain knowledge in consultation with the experts and practitioners of the subject. In addition, the increase in the studies on intraday trading, which is a shallow area in the literature, will provide better results in the studies conducted on price forecasts in the future. In the results of this study, parallel with the literature, it is revealed that there is difficulty in estimating the stock price movements.Master Thesis Predicting the Price of Bitcoin: Using Machine Learning Time Series Methods(MEF Üniversitesi Fen Bilimleri Enstitüsü, 2020) Ulutaş, Sezer; Utku KoçCryptocurrencies have greatly increased their Bitcoin-led popularity in recent years due to increased trading volumes and massive capitalization in the market. These cryptographic forms of money are not just utilized for exchanging nowadays, they are additionally acknowledged for fiscal exchanges. It appears to be evident that financial specialists, dealers and people, in general, are progressively intrigued by bitcoin and altcoins as costs rise and the arrival on ventures made increments. This examination centres around applying estimate models that will make precise value forecasts forcryptographic forms of money. The data were taken from two different exchanges and evaluated as combined dataset. As a result of the evaluation, it was determined that the prices were close to each other in terms of value and the data were combined. We obtained the daily time series data by determining the Bitcoin weighted price as a dependent variable and Open, Close, High, Low and Volume as independent variable. We predicted the next 6 months with ARIMA, LSTM and XGBoost methods. We compared these estimates using MSE, MAE, MAPE and R squared performance metrics. LSTM is the model with the best R squared value of 29.7%. In the process performed by taking the average of LSTM, XGBoost and ARIMA performed with the name of Average ML method, the R square value was found to be 41.6% as a much better result than LSTM.Master Thesis Product Recommendation for C2c Marketplace With Collaborative Filtering Als Algorithm(MEF Üniversitesi Fen Bilimleri Enstitüsü, 2021) Kıran Çelebi, Bilgehan; Utku KoçIn this project, a machine learning recommendation model is created for an e-commerce company which runs a customer to customer business. The raw data consisted order reviews, order details, product like event information and product details. The explicit and implicit feedbacks are used together and a rating generation logic per user-product couple is applied to create the source data of the model by using Google Cloud BigQuery tool. The ALS algorithm which uses matrix factorization is applied for predicting the top items which have highest ratings for each user. PySpark which is Apache Spark’s python API is used for implementing the ALS model. The best hyperparameters are determined comparing the root mean square error results by using grid search and cross validation and 0.78 of RMSE is reached. The predictions for the empty ratings are sorted then top rated 10 products are taken as recommendations. The evaluation of the model is done by comparing those recommendations with the user preferences. The user preferences are specified by using averagely top rated product categories and most interacted product categories in count. The recommendations are observed to be consistent with the user preferences.Master Thesis Predicting Customer Perfection on Brands Functional Near-Infrared Spectroscopy Measurements(MEF Üniversitesi, Fen Bilimleri Enstitüsü, 2019) Kemerci, Emre; Koç, UtkuCustomer perception on the brands have importance to give strategic decisions by marketing professionals. In classical ways, customer perception on brands are researched through conducting field surveys. Similarly, neuromarketing discipline have studies on customer behaviors, their perceptions, communication techniques etc. under the frame of decision-making process of human. In neuromarketing, functional near-infrared spectroscopy (fNIRS) is a technology used to measure oxy and deoxy hemoglobin concentration in the tissues in order to enable to analyze hemodynamic responses of the brain activities. In this study, a group of participants’ activations of prefrontal cortex so the hemodynamic responses that were collected against a set of stimuli, which is a brand logo and adjective associated with the brand is used as dataset. Measured hemodynamic response metrics are oxygenated hemoglobin (HbO), deoxygenated hemoglobin (HbR), total hemoglobin (HbT) and Oxygenation (Oxy) and the dataset includes 168 participants’ measurements for 30 stimuli. In addition, the information regarding the responses of the participants and common perception of stimuli (field study results for same stimuli) are also exists in dataset. The aim of the project is to predict through machine learning algorithms whether relation between brand and the relevant adjective is Positive, Negative or Neutral using these feature set. As methodology of this study, fNIRS measurements in the data is cleaned and Null values are handled, measurements are consolidated per participant and stimuli with two different method as feature creation and classification algorithms are used as supervised learning to predict brand perception. In conclusion, performance of support vector classifier and XGBoosting algorithms are become very low, slightly over 50% accuracy despite the optimization with different classifier parameters. Further studies are addressed as performing feature engineering studies with different options.Master Thesis Consumer Loans' First Payment Default (fpd) Detection and Predictive Model(MEF Üniversitesi, Fen Bilimleri Enstitüsü, 2018) Sevgili, Türkan; Koç, UtkuThe project is based on the opinion that whether the loan applications which are profitable could be granted instead of prone the default (FPD) ones by using predictive models in machine learning by the credit decision authorities in banking sector. Default Loan (also called non-performing loan) occurs when there is a failure to meet bank conditions and cannot be repaid in accordance with the terms of the loan which has reached its maturity. This report is a research effort in the analysis of default loan applicants, especially FPD, from a real dataset obtained from a bank. Expectation from the study is that increase the efficiency of consumer loan allocation by providing predictive analysis of the consumer behavior concerning loan’s first payment default. FPD detection analysis is a crucial role for the determination of consumer loans at the application level. The study also provides an understanding on the reasons of non-performing loans and helps to manage credit risks more consciously. The methods proposed in this study can be extended to other individual consumer loans such as car credits and mortgage.Master Thesis Analyzing the Drivers of Customer Satisfaction Via Social Media(MEF Üniversitesi, Fen Bilimleri Enstitüsü, 2019) Yücel, Kadir Kutlu; Koç, UtkuSocial media became a great influence force during the last decade. Active social media user population increased with the new generations. Thus, data started to accumulate in tremendous amounts. Data accumulated through social media offers an opportunity to reach valuable insights and support business decisions. The aim of this project is to understand the drivers of customer satisfaction by public sentiments on Twitter towards a financial institution. Data was extracted from the most popular microblogging platform Twitter and sentiment analysis was performed. The unstructured data was classified by their sentiments with a lexicon-based model and a machine learning based model. The outcome of this study showed machine learning based model successfully overcame the language specific problems and was able to make better predictions where lexicon-based model struggled. Further analysis was performed on the extreme daily average sentiment scores to match these days with prominent events. The results showed that the public sentiment on Twitter is driven by three main themes; complaints related to services, advertisement campaigns, and influencers’ impact.Master Thesis Football Player Profiling Using Opta Match Event Data: Hierarchical Clustering(MEF Üniversitesi, Fen Bilimleri Enstitüsü, 2019) Kalenderoğlu, Uğurcan; Koç, UtkuIncreasing popularity of data analytics has impacted the sport industry. Dimension of available data and best practices on the usage of data analytics increased as a result of this trend. Player profiling is one of emerging hot topics among those, especially in football. On the other hand, income and expense balance of transfers has been biggest burden on clubs’ financials while it should be reverse. Scouting processes are currently dominated by bilateral relations and intuitive comments of scouting staff. It is an important step to transform into data driven decision framework to overcome this situation. It is crucial to replace a player who leave the team with someone who has potential and very close playing style. Player profiling is the first step to do this. The data set used in this project is obtained from Opta – a sport focused data company – and contains all actions performed on-ball at player level from Turkish Super League, English Premier League and German Bundesliga in three seasons between 2015 and 2018. Principal component analysis is applied to the dataset in order to reduce dimensionality to the 15 features which consists of 2469 players and 271 features at the beginning. As a result of this study, it is observed that there are twelve different player clusters within the traditional main positions; three for defenders, four for midfielders and five for forwards. Clubs can enrich and benefit from these clusters in three ways: 1) evaluation of a player style over a period of time and detecting the best role fit 2) analyzing the effect of cluster combination to decide which line-up yields better team results 3) finding the closest match to a player who is subject to replacement.Master Thesis Mortality Prediction of Countries(MEF Üniversitesi, Fen Bilimleri Enstitüsü, 2018) Üşenmez, Elif Efser; Koç, UtkuIn this study mortality reasons of countries detailed by sex and age-group is analyzed and different forecasting models are developed by using different machine learning algorithms. The dataset is obtained from the World Health Organization(WHO) Mortality Database. In WHO database there are different datasets for countries mortality reason number. The study used the dataset that used ICD-10 for classifying mortality reasons.ICD-10 is the 10 revision of International Statistical Classification of Diseases and Related Health Problems published by the World Health Organization. In addition to main mortality reason datasets, we add different independent variables and try to find the best features to fit models without biasing and overfitting and reaching high R2 and Mean Square Errors. To find the best model for forecasting mortality reasons by age-groups and sex different machine learning algorithms are fitted and results of these algorithms are analyzed.Article Anomali Tespiti ve Suistimal Önleme: Telekomünikasyon Sektöründe Bir Uygulama(2025) Koç, Utku; Bulut, Özgür; Özalanyalı, ÖzgeBu çalışmada, telekom sektöründeki satış kanallarında ortaya çıkan anomalilerin tespitine ve suistimal olabilecek durumların engellenmesine yönelik istatistiksel bir yöntem geliştirilmiştir. Yöntemin geliştirilmesi ve test edilmesi sürecinde 371 farklı satış kanalına ait 9 aylık tüm satış bilgileriyle 340 binden fazla gerçek veri noktası kullanılmıştır. Anomali tespitinde en çok karşılaşılan engellerden biri yöntemin anomali olarak işaretlediği noktaların gerçekten anomali olup olmadığının teyit edilmesindeki zorluktur. Her bir kanalın kendi kontrol grubunu oluşturduğu bu çalışmada ise yöntemin anomali olarak işaretlediği noktaların gerçekten bir anomali olup olmadığı ilgili iş birimi tarafından değerlendirilmiş ve teyit edilmiştir. Her bir satış kanalı için günlük güven aralıkları ayrı ayrı hesaplanmış ve bu aralığın dışına çıkan durumlara hızlı tepki veren bir yöntem kullanılarak olası suistimallerin önüne geçilmiştir. Elde edilen bulgular, önerilen yöntemin anomali tespitinde başarılı olduğunu ve satış süreçlerindeki potansiyel suistimallerin önüne geçtiğini ve dolayısıyla müşteri memnuniyetini artırdığını göstermektedir. Geliştirilen yöntem yüksek performans ve ölçeklenebilirliği sağlamak için çoklu mimari yapısında uygulamaya alınmıştır. Geliştirilen yöntem ve uygulama, güvenlik ve veri bütünlüğü konularında da önemli avantajlar sunmaktadır. İlgili iş birimlerinin hızlı ve etkili kararlar alabilmesi, organizasyonun genel risk yönetimi stratejisine büyük katkı sağlamaktadır. Bu sayede, potansiyel tehditler zamanında tespit edilerek işletmenin güvenlik standartları korunmakta ve sürdürülebilir bir operasyonel çevre yaratılmaktadır. Ayrıca, projenin teknik yapısı anomali tespit sisteminin sürekli iyileştirilmesi hem yazılımın performansını artıracak hem de daha ileri düzeyde veri analizi imkanı sunacaktır. Sonuçlar, telekom şirketlerinin stratejik karar alma süreçlerine önemli katkılarda bulunarak rekabet avantajı sağlamalarına yardımcı olmaktadır.