Son Turan, Semen

Loading...

Profile URL

Name Variants

Turan, S. Semen

Semen Son

Son, Semen

Son Turan, Semen

Son-Turan, Semen

Turan, Semen Son

Semen Son Turan

Semen Son

Son, Semen

Son Turan, Semen

Son-Turan, Semen

Turan, Semen Son

Semen Son Turan

Job Title

Email Address

sons@mef.edu.tr

Main Affiliation

04.03. Department of Business Administration

Status

Current Staff

Website

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Sustainable Development Goals

2

ZERO HUNGER

1

Research Products

16

PEACE, JUSTICE AND STRONG INSTITUTIONS

2

Research Products

1

NO POVERTY

0

Research Products

11

SUSTAINABLE CITIES AND COMMUNITIES

0

Research Products

7

AFFORDABLE AND CLEAN ENERGY

0

Research Products

10

REDUCED INEQUALITIES

1

Research Products

3

GOOD HEALTH AND WELL-BEING

1

Research Products

6

CLEAN WATER AND SANITATION

0

Research Products

9

INDUSTRY, INNOVATION AND INFRASTRUCTURE

11

Research Products

12

RESPONSIBLE CONSUMPTION AND PRODUCTION

6

Research Products

5

GENDER EQUALITY

0

Research Products

14

LIFE BELOW WATER

4

Research Products

13

CLIMATE ACTION

0

Research Products

15

LIFE ON LAND

1

Research Products

8

DECENT WORK AND ECONOMIC GROWTH

6

Research Products

17

PARTNERSHIPS FOR THE GOALS

5

Research Products

4

QUALITY EDUCATION

7

Research Products

Documents

15

Citations

242

h-index

6

Documents

15

Citations

169

Scholarly Output

32

Articles

13

Views / Downloads

7342/12188

Supervised MSc Theses

2

Supervised PhD Theses

0

WoS Citation Count

169

Scopus Citation Count

242

WoS h-index

6

Scopus h-index

6

Patents

0

Projects

0

WoS Citations per Publication

5.28

Scopus Citations per Publication

7.56

Open Access Source

14

Supervised Theses

2

| Journal | Count |

|---|---|

| International Journal of Sustainability in Higher Education | 2 |

| Logistics | 2 |

| 1. Uluslararası Yükseköğretim Çalışmaları Konferansı | 2 |

| 32nd IEEE Signal Processing and Communications Applications Conference (SIU) -- MAY 15-18, 2024 -- Tarsus Univ Campus, Mersin, TURKEY | 1 |

| 3rd International Conference on Debt Crises and Financial Stability | 1 |

Current Page: 1 / 6

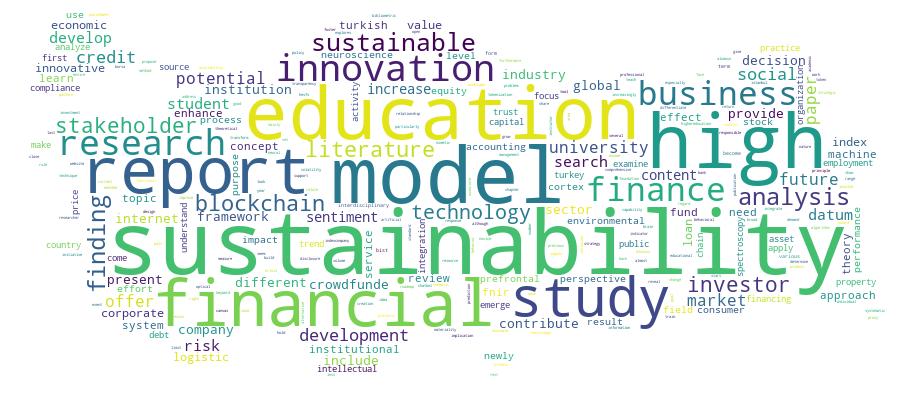

Competency Cloud